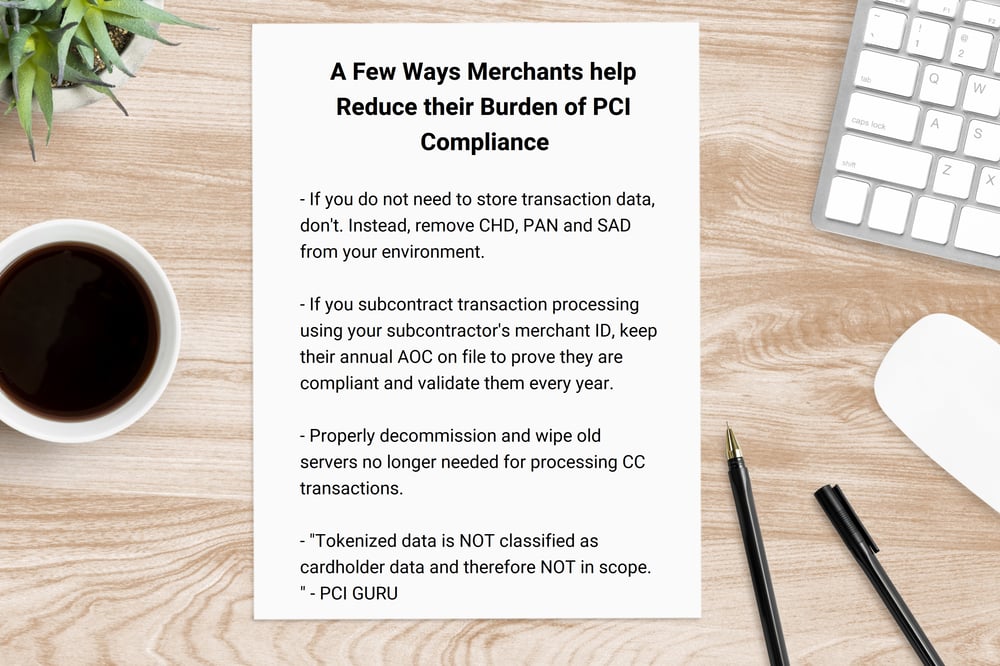

The Payment Card Industry Data Security Standard (PCI DSS) compliance can be expensive for financial institutions and transaction processors that cannot avoid touching cardholder data (CHD). However, ordinary merchants can reduce the scope with foresight, thus lowering the complexity and cost of compliance. Perhaps you can't entirely evade PCI DSS compliance, but according to experts, there are practical ways to reduce the burden for your organization.

Storing tokens instead of PANs is one alternative that can help to reduce the amount of cardholder data in the environment, thus reducing the merchant's effort to implement PCI DSS 4.0 requirements.

-

-

- Tokenization solutions do not eliminate the need to maintain PCI DSS compliance but simplify efforts by reducing scope. Tokens are not considered cardholder data.

Point-to-point encryption (P2PE) or end-to-end encryption (E2EE) solutions lead to cost reductions by reducing the number of networks and systems in scope and the cost of their PCI DSS audit effort. In addition, if you encrypt and then tunnel the data from approved devices direct to the payment processor, attackers can't touch it!

Use a payment processor to host the card data collection for you. If you outsource card data handling correctly, your PCI DSS burden is reduced to managing the risks associated with using that vendor. Attackers can't steal it from you if you never even had it!

Outsource compliance to experts. Achieving PCI DSS compliance can be complex and expensive. You can reduce effort and cost by relying on a trusted vendor to deal with it for you.

Please see our blog on defining a PCI DSS compliance checklist.

Payment Card Industry Data Security Standard – Definitions

Here is a short list of key terms used in the PCI DSS version 4.0 compliance discussions including the PCI DSS compliance certification process.

- AOC – Attestation of Compliance

- BIN – Bank Identification Number

- Card Brands – The five founding members who enforce PCI DSS - Mastercard, VISA, American Express, Discover and JCB International.

- CHD – Cardholder Data - PAN, cardholder name, card expiration date, and service code.

- CDE – Cardholder Data Environment – The people, processes and technology in the scope of the PCI audit. Those to whom does PCI DSS apply.

- PAN – Primary Account Number (the number printed on the front of the card)

- QSA – Qualified Security Assessor – qualified by PCI SSC to perform PCI DSS compliance on-site assessments

- SAD – Sensitive Authentication Data

- SAQ – PCI DSS self-assessment or PCI DSS SAQ

- Scope – The people, processes, and technologies that interact with CHD. - The part of your environment that must meet the 12 PCI DSS requirements.

Why Truvantis

Let us deal with compliance so you can invest in your business. The Truvantis® team comprises PCI DSS experts and Qualified Security Assessors with extensive experience as a trusted partner for compliance and validation. Outsource your payments, segment your networks, tokenize your data, and use P2PE/E2EE solutions – all are great ways to reduce your costs. But the devil is in the details – contact Truvantis to ensure you get it right.

Truvantis is a cybersecurity, compliance and privacy consulting organization with comprehensive expertise in implementing, testing, auditing, and operating information security programs. We specialize in helping our clients improve their cybersecurity posture through practical, effective, and actionable programs—balancing security, technology, business impact, and organizational risk tolerance.

Truvantis is also an authorized PCI DSS Qualified Security Assessor (QSA) company.

.png)

.png)